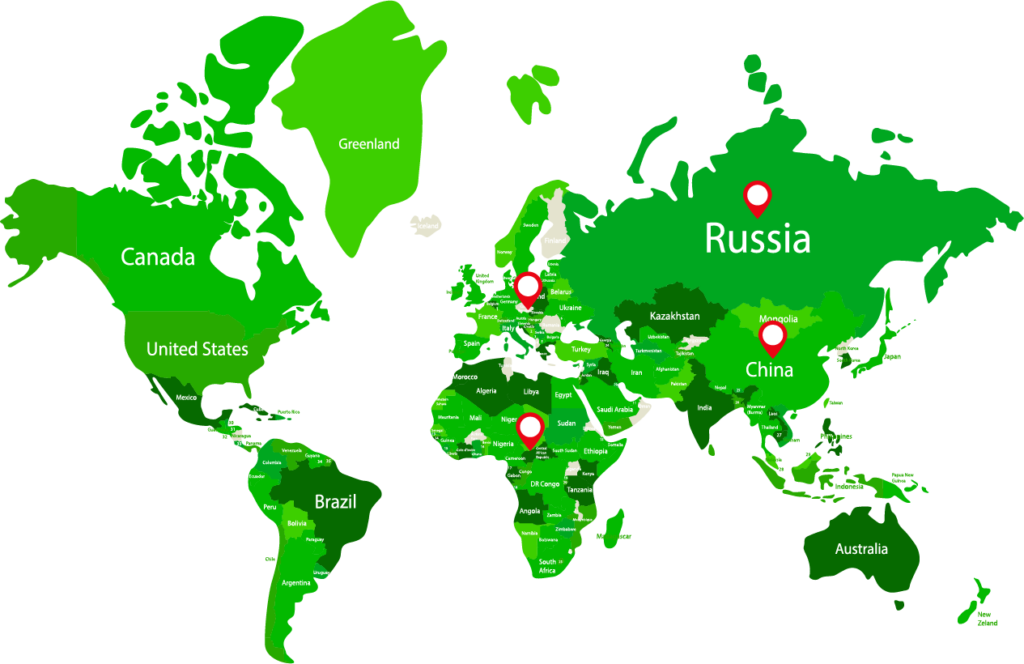

ایران به دلیل موقعیت جغرافیایی نزدیک به روسیه، یکی از بازارهای اصلی برای واردات چوب از این کشور است. چوب روسی از کیفیت بسیار بالا و استحکام فوقالعادهای برخوردار است

محصولات پرسال

شرکت های زیرمجموعه پرسال

چرا شرکت پرسال

گروه شرکتهای پرسال، در سال ۱۳۷۵ توسط پدرام سلطانی تأسیس شد. از آن زمان تاکنون شرکت پرسال با بهرهگیری از توان و تجربه مدیرانی کارآمد و همکارانی متخصص و کارآزموده از یک سو و تکیه بر رویکردهای علمی و عملی سرامد در شیوههای نوین تجارت جهانی از سوی دیگر، این افتخار را داشته که از رشد و توسعه قابل ملاحظهای برخوردار شود. حوزه فعاليت اوليه شرکت پرسال، صادرات فرآوردههای نفتی و پتروشيمي بوده است؛ پرسال در حال حاضر علاوه بر حوزه اولیه کاری خود در زمینههای دیگری همچون تجارت فرآوردههای چوب و کاغذ، و محصولات شیمیایی، پلیمری و همچنین عمليات اکتشاف و بهرهبرداری از معادن فعال است.

تازههای پرسال

آیا استفاده از مقوا برای بسته بندی جعبه های دارویی بهداشتی است؟

آشنایی با مهمترین مزایا و معایب چوب روسی

تنوع بالای چوبهای روسی، کاربرد آسان، استحکام و مقاومت بالا و قیمت مناسب نسبت به سایر انواع چوب از ویژگیهایی است که موجب محبوبیت چوبهای روسی در بازار شده است.

سوالات متداول

برای استعلام قیمت با شماره مستقیم 26208325 تماس حاصل نمایید.

به دلیل واردات بدون واسطه با قیمت رقابتی در بازار عرضه می شود.

- استعلام قیمت

- ثبت سفارش

- استعلام موجودی

- بارگیری محصول

- ارسال

- قیمت رقابتی

- ارسال سریع

- کیفیت محصولات

پس از ثبت سفارش چوب طی 2 تا 3 روز کاری بارگیری انجام می شود. و زمان تحویل بار بستگی به میزان مسافت محل تحویل بار دارد. و برای خرید کاغذ پس از ثبت سفارش و پرداخت در همان روز ارسال می شود.